Forecast for March 4 :

Analytical review of currency pairs on the scale of H1:

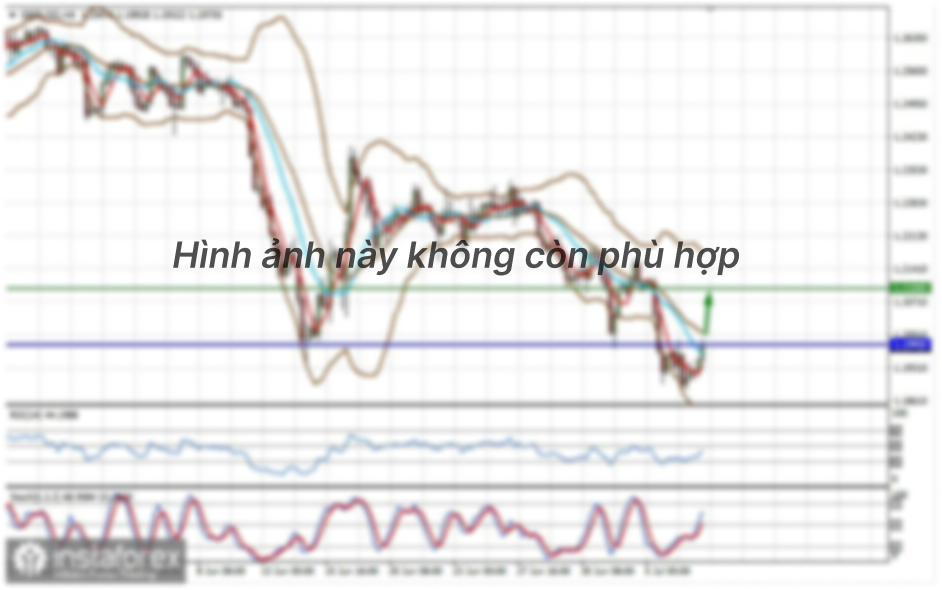

For the euro / dollar pair, the key levels on the H1 scale are: 1.1322, 1.1268, 1.1242, 1.1196, 1.1116, 1.1083 and 1.1029. Here, we are following the local upward cycle of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 1.1196. In this case, the target is 1.1242. Price consolidation is in the range of 1.1242 - 1.1268. For the potential value for the top, we consider the level of 1.1322. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is expected in the range 1.1116 - 1.1083. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1029. This level is a key support for the top, its passage at the price will lead to the formation of initial conditions for the downward cycle.

The main trend is the local upward cycle of February 28

Trading recommendations:

Buy: 1.1196 Take profit: 1.1242

Buy: 1.1268 Take profit: 1.1320

Sell: 1.1116 Take profit: 1.1084

Sell: 1.1081 Take profit: 1.1030

For the pound / dollar pair, the key levels on the H1 scale are: 1.2866, 1.2827, 1.2795, 1.2759, 1.2717, 1.2689 and 1.2631. Here, we are following the development of the downward cycle of February 25. The continuation of movement to the bottom is expected after the breakdown of the level of 1.2759. In this case, the first goal is 1.2717. Short-term downward movement is possibly in the range of 1.2717 - 1.2689. The breakdown of the last value will lead to a movement to a potential target - 1.2631. Upon reaching this level, we expect a pullback to the top.

Consolidated movement is possibly in the range of 1.2795 - 1.2827. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2866. This level is a key support for the downward movement.

The main trend is the downward cycle of February 25.

Trading recommendations:

Buy: Take profit:

Buy: 1.2828 Take profit: 1.2864

Sell: 1.2759 Take profit: 1.2718

Sell: 1.2717 Take profit: 1.2690

For the dollar / franc pair, the key levels on the H1 scale are: 0.9655, 0.9622, 0.9598, 0.9553 and 0.9518. Here, the price is near the limit values for the descending cycle of February 20. In connection with which, we expect a correction. Short-term upward movement is possibly in the range of 0.9598 - 0.9622. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9655. This level is a key support for the downward structure.

Short-term downward movement is possibly in the range of 0.9553 - 0.9518. From here, we expect a key reversal to the top.

The main trend is a downward cycle of February 20, we expect a correction

Trading recommendations:

Buy : 0.9598 Take profit: 0.9621

Buy : 0.9624 Take profit: 0.9653

Sell: 0.9551 Take profit: 0.9520

Sell: Take profit:

For the dollar / yen pair, the key levels on the scale are : 108.51, 107.76, 107.33, 106.77, 106.43 and 105.74. Here, we are following the development of the downward cycle of February 21. Short-term downward movement is expected in the range of 106.77 - 106.43. The breakdown of the last value will lead to movement to a potential target - 105.74, when this level is reached, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 107.33 - 107.76. The breakdown of the latter value will lead to an in-depth correction. In this case, the target is 108.50. This level is a key support for the downward structure.

The main trend: the downward cycle of February 21

Trading recommendations:

Buy: 107.33 Take profit: 107.74

Buy : 107.78 Take profit: 108.50

Sell: 106.77 Take profit: 106.45

Sell: 106.40 Take profit: 105.74

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3409, 1.3373, 1.3350, 1.3308, 1.3282, 1.3262, 1.3224 and 1.3201. Here, we are following the formation of the descending structure of February 28. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3308. In this case, the target is 1.3282. Price consolidation is near this level. The passage at the price of the noise range 1.3282 - 1.3262 should be accompanied by a pronounced downward movement. Here, the target is 1.3224. For the potential value for the bottom, we consider the level of 1.3201. Upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possibly in the range of 1.3373 - 1.3409. There is a high probability of a downward reversal from this range. At the same time, the breakdown of the level of 1.3410 will lead to the formation of initial conditions for the upward cycle. In this case, the target is 1.3464.

The main trend is the formation of the downward structure of February 28

Trading recommendations:

Buy: 1.3375 Take profit: 1.3409

Buy : 1.3412 Take profit: 1.3460

Sell: 1.3308 Take profit: 1.3282

Sell: 1.3260 Take profit: 1.3225

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6701, 0.6667, 0.6649, 0.6623, 0.6602, 0.6571, 0.6558 and 0.6539. Here, we are following the development of the upward cycle of February 28. Short-term upward movement is expected in the range of 0.6602 - 0.6623. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 0.6649. Short-term upward movement, as well as consolidation is in the range of 0.6649 - 0.6667. For the potential value for the top, we consider the level of 0.6701. Upon reaching which, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.6571 - 0.6558. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6539. This level is a key support for the top.

The main trend is the upward cycle of February 28

Trading recommendations:

Buy: 0.6602 Take profit: 0.6620

Buy: 0.6625 Take profit: 0.6649

Sell : 0.6570 Take profit : 0.6558

Sell: 0.6556 Take profit: 0.6540

For the euro / yen pair, the key levels on the H1 scale are: 122.07, 121.61, 121.36, 120.92, 120.23, 119.95 and 119.54. Here, we are following the formation of the initial conditions for the top of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 120.23. In this case, the first goal is 120.92. The breakdown of which, in turn, will allow you to count on the movement to 121.36. Price consolidation is in the range of 121.36 - 121.61. For the potential value for the top, we consider the level of 122.07. Upon reaching which, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 119.54 - 119.31. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 118.87. This level is a key support for the upward structure.

The main trend is the formation of initial conditions for the top of February 28

Trading recommendations:

Buy: 120.25 Take profit: 120.90

Buy: 120.92 Take profit: 121.36

Sell: 119.30 Take profit: 119.00

Sell: 118.85 Take profit: 118.44

For the pound / yen pair, the key levels on the H1 scale are : 139.34, 138.82, 138.21, 137.79, 136.91 and 136.11. Here, we are following the downward cycle of February 21. The continuation of movement to the bottom is expected after the breakdown of the level of 136.90. In this case, the goal is 136.11. Upon reaching this level, we expect a rollback to correction.

Short-term upward movement is possibly in the range of 137.79 - 138.21. The breakdown of the last value will lead to the development of an in-depth correction. Here, the goal is 138.82. This level is a key support for the downward cycle. Its breakdown will lead to the formation of an upward structure. In this case, the goal is 139.34.

The main trend is the downward cycle of February 21.

Trading recommendations:

Buy: 137.80 Take profit: 138.20

Buy: 138.25 Take profit: 138.80

Sell: 136.90 Take profit: 136.11