The GBP/USD currency pair traded cautiously on Wednesday evening and throughout Thursday, despite several fundamental catalysts at play. This hesitation was largely due to the market receiving the information it had anticipated. On Wednesday evening, the Federal Reserve decided to keep the key interest rate unchanged. During the press conference, Jerome Powell affirmed that the Fed would not yield to suggestions from President Donald Trump. These concerns were at the forefront of investors' minds, and the responses provided were precisely what everyone expected.

It's important to note that President Trump has previously expressed his intention to pressure the Fed for interest rate cuts. During his first term, he frequently urged the Fed to lower rates, but Powell and his team maintained the central bank's independence in the face of his provocations. We expected that this situation would remain unchanged, although some doubts lingered. After all, Powell is not the Fed Chair indefinitely; Trump could have offered him an extension of his term in exchange for greater loyalty. However, as demonstrated, Powell appears uninterested in such arrangements. Consequently, the U.S. dollar has reaffirmed its potential to strengthen against competitors in 2025. On the other hand, the European Central Bank is likely to lower rates to 2% by summer, and the Bank of England, which has a meeting scheduled for next week, is preparing to implement up to four rate cuts.

In light of recent developments, it's important to note that the ongoing rise of the pound and the euro over the past three weeks is merely a corrective phase. We previously warned that a correction was on the horizon in the daily timeframe, and it was likely to be quite pronounced. Therefore, we wouldn't be surprised if GBP/USD continues to rise for several more weeks, or even longer. The pound could easily reach the 1.27–1.28 range based purely on these corrective movements. However, this upward trend will not change the overall technical outlook, nor will it be fundamentally justified.

The British economy remains as weak as the European economy, and the BoE has a much more dovish stance compared to the Fed. So, what is driving the strength of the pound? At this stage, the market seems to be weighing whether to continue the correction or resume the downtrend. We also have a trendline and the Ichimoku indicator that suggest the trend direction across all timeframes. Even on the hourly chart, it remains uncertain whether the three-week uptrend has come to an end.

Additionally, the BoE meeting is scheduled for next week. A more dovish stance from the central bank increases the likelihood that the pound's decline will continue without ever reaching the 1.27–1.28 range. While Donald Trump has certainly influenced the U.S. dollar, a correction was inevitable regardless. Observing the daily timeframes, even the current rise of the euro and the pound appears relatively weak. Thus, although Trump may have triggered the dollar's decline, the correction was bound to happen.

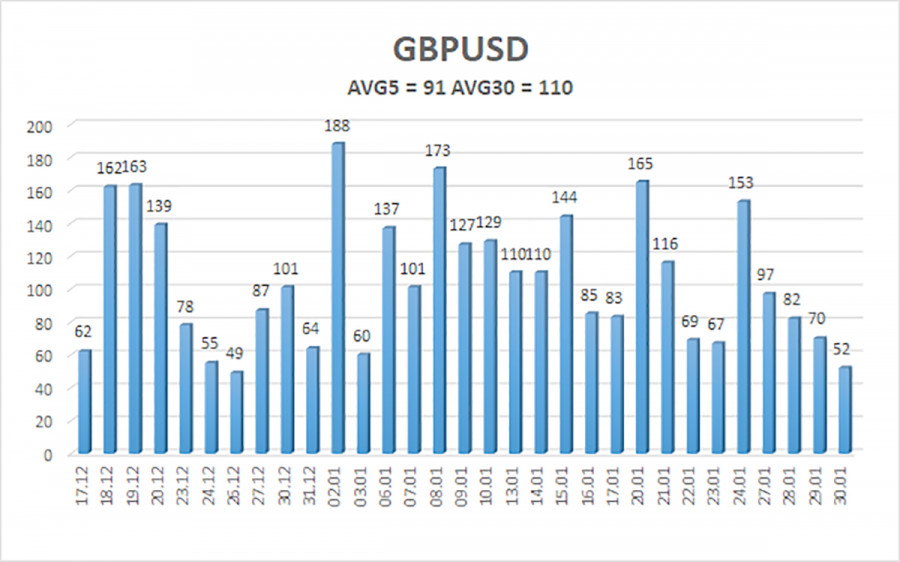

The average volatility of the GBP/USD pair over the last five trading days is 91 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, January 31, we expect movement within the range limited by the levels of 1.2367 and 1.2549. The higher linear regression channel remains directed downward, signaling a bearish trend. The CCI indicator entered the overbought area and formed a bearish divergence. A resumption of the downward trend is expected.

Nearest Support Levels:

S1 – 1.2451

S2 – 1.2390

S3 – 1.2329

Nearest Resistance Levels:

R1 – 1.2512

R2 – 1.2573

R3 – 1.2634

Trading Recommendations:

The GBP/USD currency pair is currently experiencing a medium-term downward trend. We do not recommend taking long positions at this time, as we believe that all factors supporting the British currency have already been factored into the market multiple times, and there are no new catalysts for growth.

If you are trading based solely on technical indicators, long positions could be considered if the price rises above the moving average, targeting levels at 1.2512 and 1.2549. However, sell orders are still more relevant, with targets set at 1.2207 and 1.2146, but now a firm consolidation below the moving average is required.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.