The EUR/USD currency pair traded lower for most of the day on Wednesday. In this article, we will not address the results of the Federal Reserve meeting, as is customary, nor will we discuss the market movements that occurred after their announcement. It's important to note that the market's initial reaction to significant events is often emotional. Even when the information is clear-cut, traders frequently react impulsively, only to return to their original positions the following day. Therefore, we prefer to analyze market behavior 12 to 15 hours after such events.

However, the European Central Bank meeting will occur within that same timeframe, and surprises are certainly possible. The ECB has adopted a decidedly dovish stance and plans to reduce the key interest rate to a neutral level of around 2% by mid-year. Nevertheless, there is uncertainty regarding whether the ECB will stop easing monetary policy beyond that point. Several ECB representatives have indicated that the rate could be lowered further than 2%. Moreover, the primary concern for the ECB at this point is not inflation, but rather the rate of economic growth.

Consequently, there is little doubt that the ECB will cut the key rate by 0.25% today. The crucial question is how the rate will change once it reaches 2%. How will inflation respond to such a significant easing of monetary policy? More importantly, how will the economy react? The ECB aims to stimulate the European economy, which has essentially stagnated for over two years. If the 2% rate fails to spur the economy as expected, further monetary easing may be necessary.

The path ahead for the European currency appears to lead to a decline. One of the primary threats to the American dollar is Donald Trump. If he initiates trade wars with numerous countries, it will impact the American economy as well. This could lead to increased inflation globally, prompting the Fed to consider raising interest rates at some point. However, Trump is unlikely to support such a move, as he wants to both challenge and ease monetary policy. Fortunately, the Fed operates independently of the U.S. President, which significantly reduces the chances of Chairman Powell acting on Trump's orders.

So, what can we expect? It is highly probable that the ECB will continue to lower interest rates, even once the 2% target is reached. Conversely, the Fed may reduce rates by 0.5% during 2025, bringing them down to around 4%. Given the current economic landscape and the ongoing downward trend of the EUR/USD pair—lasting for 16 years—there seems to be little chance for a significant recovery. While the Euro may experience temporary growth over a week or a month, this should be viewed as a correction rather than a change in direction. Overall, the fundamental global factors and trends remain unchanged.

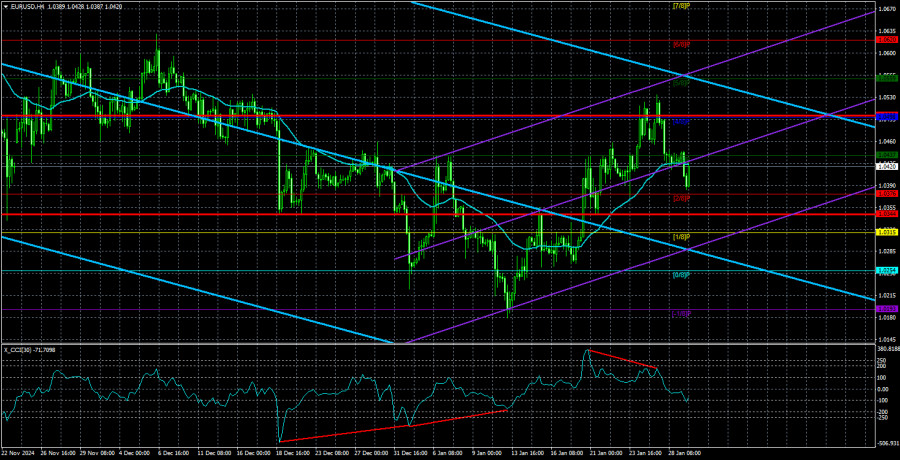

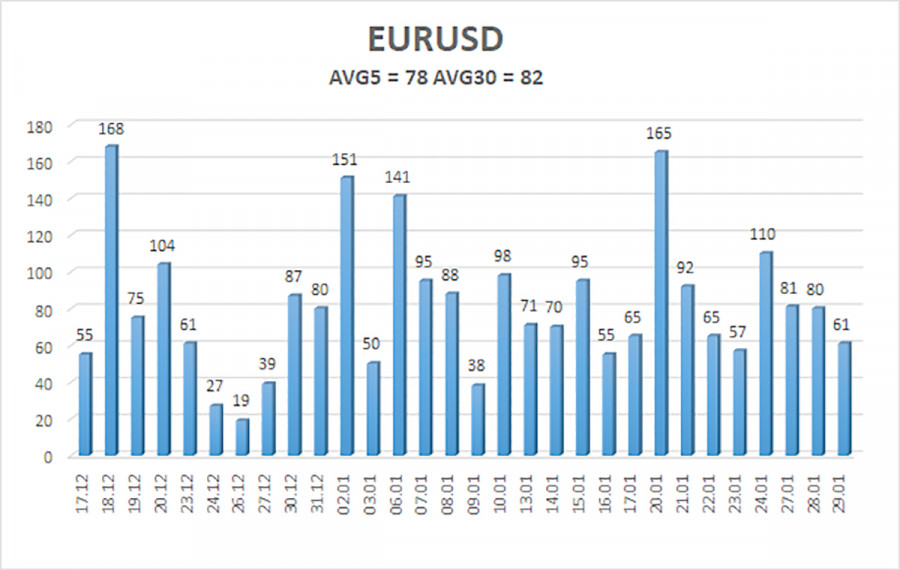

As of January 30, the average volatility of the EUR/USD currency pair over the past five trading days is 78 pips, which is considered "moderate." We expect the pair to trade within the 1.0344 – 1.0500 range on Thursday. The higher linear regression channel remains downward-directed, indicating that the global downtrend is intact. The CCI indicator entered overbought territory and formed a bearish divergence, leading to a renewed decline.

Nearest Support Levels:

- S1 – 1.0376

- S2 – 1.0315

- S3 – 1.0254

Nearest Resistance Levels:

- R1 – 1.0437

- R2 – 1.0498

- R3 – 1.0559

Trading Recommendations:

The EUR/USD pair continues its upward corrective movement. Over the past few months, we have repeatedly emphasized that we expect the euro to decline in the medium term, meaning the current correction is incomplete. The Fed has paused its monetary easing, while the ECB is accelerating its rate cuts. Apart from technical corrective factors, the U.S. dollar still has no fundamental reasons for a sustained decline.

Short positions remain relevant, targeting 1.0254 and 1.0193, but a clear completion of the current correction is required. If you trade based on pure technical analysis, long positions can be considered if the price moves above the moving average, with targets at 1.0498 and 1.0500. However, any upward movement should currently be viewed as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.