The GBP/USD pair continued its downward movement on Friday. While Friday's drop can be attributed to strong U.S. labor market and unemployment data, earlier declines were blamed on the "bond crisis" in the UK. However, the pound sterling has been falling for three consecutive months, a trend we predicted as early as 2024. These factors—whether strong U.S. data or UK-specific issues—are merely local contributors to the decline. Globally, the situation remains unchanged: the pound is still oversold, and its price does not yet reflect the anticipated monetary policy easing by the Bank of England, unlike the dollar, which already factors in the Federal Reserve's easing.

On Friday, the strong NonFarm Payrolls and U.S. unemployment rate reports did indeed trigger the pair's decline. However, global factors continue to pressure the pound downward, even without macroeconomic data. A glance at the weekly timeframe confirms there is still room for the pound to fall. We continue to expect the pair to reach 1.1800. Over the longer term, the decline could be much steeper as the 16-year downtrend remains intact.

Similar to the euro, the pound is likely to face challenges in finding support in the coming week. On Wednesday, the UK is set to release December inflation data, which is expected to rise to 2.7%. Additionally, reports on November GDP, industrial production, and retail sales are scheduled for release. While these reports may have a slight impact on the GBP/USD pair in the short term, they are unlikely to change the ongoing three-month downtrend, much less the trend observed over the past sixteen years.

As for the potential for U.S. events to lower the dollar's exchange rate, initial indications suggest no significant changes. The U.S. economic calendar for the next five days includes the Producer Price Index (PPI), December inflation data, retail sales, jobless claims, new home sales, building permits, and industrial production reports. All of these, except for inflation data, are expected to have only a localized effect on market sentiment. But what about the inflation figures?

The Consumer Price Index (CPI) for December is projected to rise to between 2.8% and 2.9%. This increase would reinforce the Federal Reserve's cautious approach regarding interest rate cuts. If inflation accelerates beyond expectations, the strength of the dollar is likely to continue. Currently, the Fed is indicating there may be two rate cuts in 2025, with the market anticipating two reductions of 0.25% each. However, what if those anticipated cuts do not materialize? In just eight days, Donald Trump will assume the presidency of the United States. His potential reintroduction of tariffs and policies that could contribute to global inflation adds an element of uncertainty to the economic outlook. If inflation continues to rise, the Fed might refrain from cutting rates at all over the next 12 months. The market has priced in 6 or 7 rate cuts by the Fed in 2024 and is anticipating 4 additional reductions in 2025.

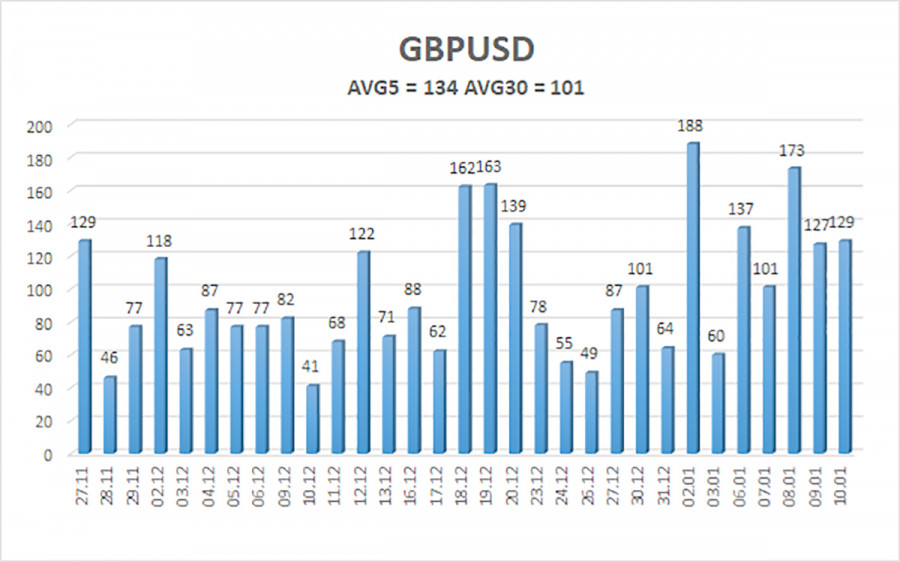

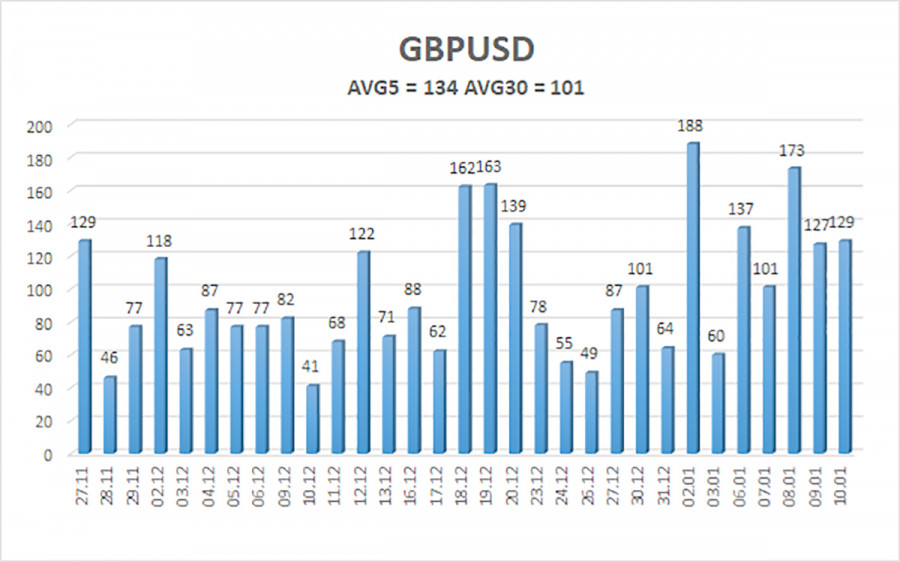

The average volatility of the GBP/USD pair over the last five trading days is 134 pips, which is considered high for this currency pair. On Monday, January 13, we anticipate that the pair will trade within a range between the levels of 1.2071 and 1.2339. The higher linear regression channel is trending downward, indicating a prevailing downtrend. The CCI indicator has once again entered the oversold zone; however, oversold signals in a downtrend typically signal only a correction. A bullish divergence in the indicator previously signaled a correction, which has now concluded.

Nearest Support Levels:

S1: 1.2207

S2: 1.2085

S3: 1.1963

Nearest Resistance Levels:

R1: 1.2329

R2: 1.2451

R3: 1.2573

Trading Recommendations:

The GBP/USD pair continues to follow a downward trend. It is not advisable to take long positions at this time, as we believe that all factors supporting the pound's growth have already been priced in multiple times, and there are currently no new bullish drivers.

For traders who use "pure technical analysis," long positions may be considered if the price rises above the moving average, with targets set at 1.2451 and 1.2573. However, sell orders are still much more relevant, with targets at 1.2207 and 1.2085.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.