The markets are on the rise at the beginning of the trading week, so the bulls are celebrating the victory in this battle. However, the long-term outlook remains challenging. Economists predict that the Federal Reserve's battle with inflation will cause more economic damage than they previously assumed.

Inflation will leave deep scars: two studies

Presented in the fall of 2022 at the acclaimed Washington DC BPEA Economists Conference, which has hosted many Nobel laureates since its inception in 1970, the papers outline the risks ahead for the global economy. And while the bulls are enjoying the thaw, analysts are not so rosy.

Containing brief summaries of several studies, two deliverables contain warnings to banks, governments and other stakeholders. In particular, economists are confident that the Fed's fight to control inflation is likely to do more damage to the US and global economy than currently appears.

According to a paper prepared for the Brookings Institution conference on Sept. 8-9, Fed Chairman Jerome Powell and his colleagues may have to increase unemployment significantly to reach the 2% inflation target. The figures they cite prove that the Fed is likely to have to raise unemployment well above its 4.1% forecast if it wants to bring inflation down to its 2% target by the end of 2024.

Specifically, the generalized inflation forecast, as measured by the Commerce Department's Personal Consumption Price Index (PCE), was 2.2% at the end of 2024, compared to a four-decade high in June of 6.8%. The PCE index slightly decreased in July (prices increased by 6.3% compared to the previous year). The Labor Department's more widely known consumer price index (CPI) also hit a 40-year high in June (9.1%) before slipping slightly to 8.5% in July.

While a soft landing for the US economy is still not out of the question, it is achievable only under the most favorable scenarios, Johns Hopkins University professor Laurence Ball, as well as International Monetary Fund economists Daniel Lee and Prachi Mishra write in their article. In other words, if all market participants behave as expected and the economy is not shaken by a new global cataclysm.

"The forecasts of Fed policymakers - inflation will return to the target value, and unemployment will barely exceed 4.1% — are reasonable only with fairly optimistic assumptions," notes a group of experts led by Professor Laurence Ball.

So far, the Fed's reaction has been moderate (no matter how hawkish its policy may seem to us), as it raised its short-term target interest rate by 2.25 percentage points, almost from zero. In July, Powell's subordinates believed that in order to contain inflation, they would need to raise the target rate by just an additional percentage point over a year and a half, and probably by a percentage point next year.

As a result, they, as well as most independent economists, expected that the increase in inflation, which began in March 2021, would be temporary, which the bulls are now counting on.

The document identifies three reasons why these expectations are strategically wrong. Firstly, unforeseen events, such as the conflict in Ukraine and constant disruptions in the supply chain due to the pandemic. Secondly, the inability to take into account the impact of specific price shocks (for example, energy prices and cars) on the base or base level of inflation. Finally, the focus on the unemployment rate (which only recently fell to the pre-pandemic level) as an indicator of tension in the labor market, and not on a very high ratio of vacancies and unemployed (V/U), which, of course, facilitated the indicators, and therefore the work of the Fed, but little corresponded to reality.

A very high V/U ratio starting in 2021 may better explain the three-quarters increase in monthly core CPI inflation measured by the Federal Reserve Bank of Cleveland index, which excludes the effects of unusually large price changes in certain industries. In part, the consumer demand that fueled the economy, as well as the tension in the labor market, in turn, can be explained by the US $1.9 trillion rescue plan adopted by the Biden administration in March 2021. Without it, according to the authors, the annual monthly core inflation would have been almost half as much in July, not 6.5%. What we talked about a year ago – the release of huge pools of "cheap dollar" to support pants - added inflation of almost 3%.

The authors of the article naturally doubt whether the Fed will be able to achieve its goals. This primarily depends on whether it is possible to slow down demand in such a way that the number of vacancies decreases, but unemployment does not increase (the return of the V/U ratio to its pre-pandemic norm). To do this, it is necessary to organize a decline in production, while retaining, however, the aspirations of employees to hold on to a place.

In fact, this requires exactly what the financial markets are so stubbornly opposed to – market and production pessimism. Is it possible, with such a pressure of bulls, to expect consumers and businesses to believe that high inflation will persist in the long term, and thus plan it in their spending for the future? I doubt it very much.

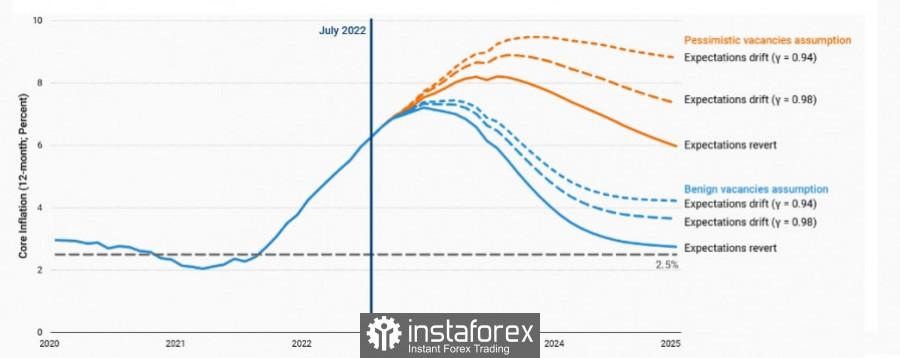

With optimistic assumptions about both the V/U ratio and long-term inflation expectations among consumers and producers (and assuming that the Fed's forecast for unemployment at 4.1% turns out to be correct), the document predicts that the Fed will reduce core inflation almost to its target level by the end of 2024. However, under the most pessimistic assumptions about both the V/U ratio and inflation expectations, core inflation rises to about 8.8% if unemployment rises to only 4.1%.

In fact, I think that when the bulls run out of money, the market will experience several sharp collapses, as it has always happened before. And it will still be unexpected enough collapses to leave many borrowers without pants. Immediately after that, pessimism will prevail in the manufacturing sector, allowing the Fed to achieve core inflation of about 6-6.5%, no higher. However, it will be quite a difficult path. The authors believe that either inflation will remain significantly higher, or we will have higher unemployment and a significant slowdown in the economy, but probably both of these indicators will be moderately higher than today's official forecasts.

The consequences will affect not only the United States

Another interesting study was a report by former IMF chief economist Maurice Obstfeld, co-authored with Haonan Zhou from Princeton University, who predicted problems for many emerging markets and developing countries due to the exorbitant growth of the dollar.

According to them, these economies are particularly vulnerable due to the accumulation of debt by the public sector and enterprises during the pandemic, mainly in dollars. The dollar has strengthened significantly since mid-2021, and the global financial cycle is now in a phase of contraction.

Their study, The Global Dollar Cycle, uses a statistical model that tracks variables in 26 emerging economies to document how shocks from the appreciation of the dollar lead to economic downturns - a characteristic feature of the global economy since the early 1970s, when the Bretton Woods system of fixed exchange rates collapsed.

The assumption that emerging economies are taking on the burden of dollar pressure has been confirmed: the increase in public and business sector debts during the COVID-19 pandemic has made EMDEs particularly vulnerable to dollar appreciation. Most loan agreements are concluded mainly in dollars. So it turns out that a stronger dollar increases the burden of their debts in terms of the output of their domestic economy. This, combined with higher interest rates and slower economic growth (which reduces government tax receipts and business profits), makes it harder to pay off EMDEs' debts.

By itself, the latest jump in the dollar is not yet exceptionally large, although the annual growth looks frightening. The situation is complicated by the fact that this is happening at a time when the global economy is facing constant disruptions in supply chains related to the pandemic, the conflict in Ukraine and inflation for basic goods. And even for domestic consumers, an expensive dollar is not only a plus.

This may make the denouement of this episode with the appreciation of the dollar especially gloomy.

However, the authors suggest options that countries can implement to mitigate the adverse effects of a stronger dollar.

EMDEs can strengthen their defenses against a rising dollar by primarily minimizing their dollar debt, providing flexibility to their exchange rates, and creating central banks with strong anti-inflationary confidence.

Indeed, many EMDE central banks started raising their interest rates last year, ahead of the Fed and other central banks of advanced economies. This should, according to Obstfeld, provide these EMDEs with some protection from the financial crisis. The price for this will be a slowdown in the growth of national GDP – an effect that only Japan has managed to avoid so far.

Unlike the authors of the first study, the researchers believe that the Fed's actions at the beginning of the pandemic, including credit lines to other central banks, as well as the mechanism that allowed foreign central banks to sell their US treasury securities, were "especially important for stabilizing global financial markets." But, as the authors immediately note, "the Fed got into the game quite late" with an increase in its short-term interest rate to counteract inflation.

The document predicts that the Fed and other central banks of advanced economies will probably be able to tame inflation, but warns that there is a danger that central banks will jointly cause an unnecessarily sharp global recession.

However, if the Fed cannot cope with inflation, other risks loom, the duo writes. According to Obstfeld and Zhou, this will be devastating for the global economy in the long run and could undermine the role of the dollar as a key global reserve currency. For example, inflation in India as of September 12 has already exceeded 7% due to rising food prices, while Bangladesh has already moved to restrict exchange operations in an attempt to stop domestic demand for the dollar.

Perhaps Bank of Japan Governor Haruhiko Kuroda could not have chosen a better moment for his global plans. Because, probably, inflation at the end of 2023 will still exceed the planned figures. And even if they are revised upward in the winter, the impact on the US economy will be even stronger due to a decrease in imports due to the high dollar, as well as a drop in global demand.

Linking these two studies together, the picture is not rosy. Of particular concern is the end of this year, which will also account for the largest consumption of fuel reserves in the EU area, which may affect energy futures prices due in the summer of 2023. Add to this the escalation of the conflict in Ukraine, which may affect grain supplies from the Black Sea, and the possible escalation of conflicts involving Serbia, Israel and Iran. And let's not forget about the next outbreak of coronavirus, which will instantly complicate the already tense situation in the markets. Most likely, the target threshold of inflation, as well as unemployment, for the Fed will still rise. And although the markets will certainly cope, the bulls will have a hard time over the next two years.